As your child plans their next steps after school, understanding finances is crucial. Whether they’re heading to college, starting an apprenticeship, or entering the workforce, knowing how to manage money will help them achieve their goals.

Here are some key areas to focus on:

Budgeting for Education Expenses

- Tuition and Fees – If your child is going to college, they’ll need to budget for books, and other fees such as travel and lunch. Help them research grants available from the college they have chosen to help budget this.

- Understanding Student Loans – If your child decides to go to university, you should help explain how repayment plans work and what their options are after they graduate. More info on the repayment of student loans.

- Savings – Encourage your child to start saving early for future expenses, whether it’s further education, a car, or travel.You could introduce them to different investment options to grow their money over time.

- Download – Monthly Budget Planner for School Leaver

- Martin Lewis Student Finance – Martin Lewis: Student finance & financial education videos

How Does a Salary Work?

If your child decides to start an apprenticeship, they will receive a wage alongside study. It will help if you explain a few things about receiving a salary and how to budget.

- Gross vs. Net Pay – Explain that gross pay is their total salary before any tax or NI deductions, while net pay is what they take home after taxes and other deductions. Job adverts quote the Gross pay so it helps if they understand how to work out what net pay they will be left with each week to budget.

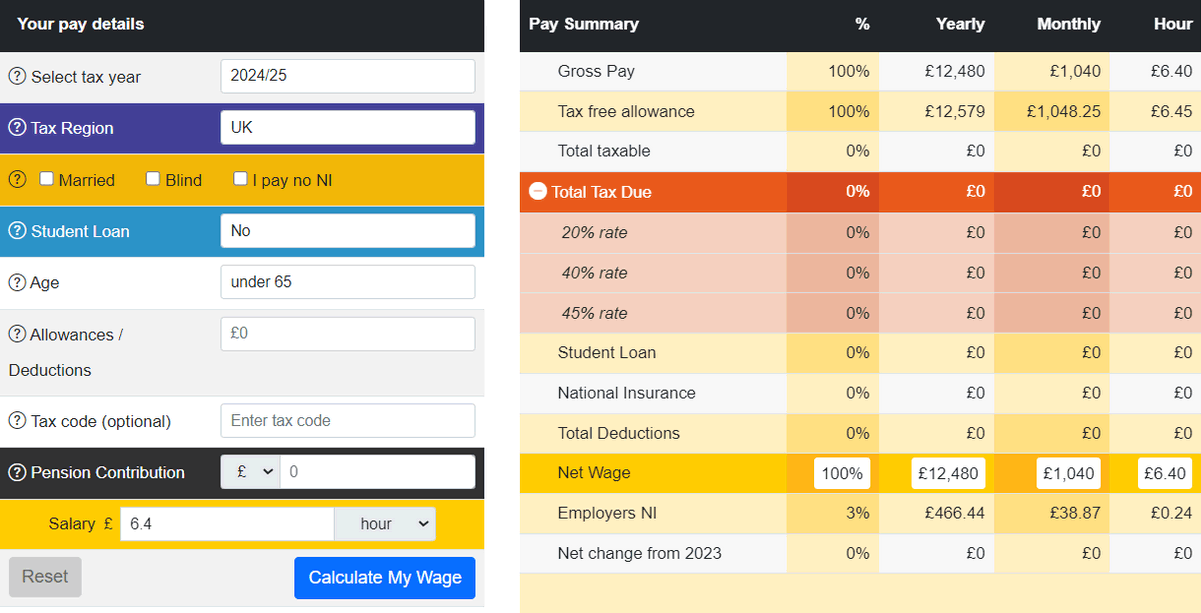

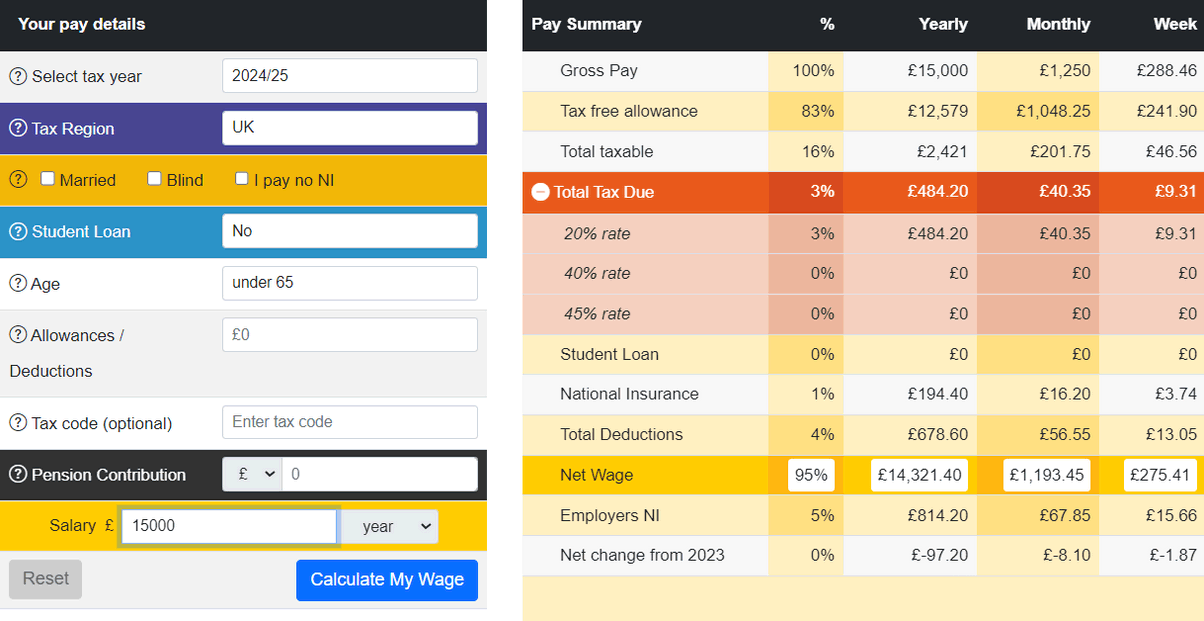

- Practical Resource – Visit the free site “Listen to Tax Man” to see real examples of how salaries and taxes work. This will give them a clear idea of how much money they’ll actually have to spend each month after tax.

Example 1 above shows min wage for a 16 year old taking an apprenticeship or going into full time work is £6.40 – the site shows that there will be zero deductions every month for NI and TAX as an apprenticeship wage is below the tax and NI threshold leaving your child with 1040 net income a month if they are employed in the apprenticeship full time.

Example 2 above shows an example of a 16 year old taking an apprenticeship that is paying above the minimum apprenticeship wage and offers £15,000 a year – the site shows that there will be £56.55 of deductions every month for NI and TAX as this apprenticeship wage is above the tax and NI threshold leaving your child with £1193.45 net income a month if they are employed in the apprenticeship full time.

- Living Expenses – Consider any accommodation, food, transportation, and other daily expenses your child will incur once they leave school. Encourage them to create a budget to ensure they can cover these costs throughout their studies. Check out this example budget planner you can use once you have calculated their net pay here.